| |

|

|

|

A True-to-Life Illustration

A True-to-Life Illustration

Stan and Sally Hill (not their real names) are a typical example. Almost 25 years ago, they bought rental property as an investment for $350,000. They worked hard, made a decent living, and raised four children. However, now they are planning for retirement (both are 60 years old).

Stan and Sally Hill (not their real names) are a typical example. Almost 25 years ago, they bought rental property as an investment for $350,000. They worked hard, made a decent living, and raised four children. However, now they are planning for retirement (both are 60 years old).

Selling the property seems like a good idea, so Stan and Sally have it appraised. They are very excited to find that the property’s current value is $1,000,000! The Hills are ecstatic until they visit with an accountant friend who tells them about capital gains tax.

The accountant explains that if they sell the property they will realize a gain of $875,000 ($1,000,000 current worth, less the original price of $350,000 and depreciation they have taken of $225,000.) He tells them that under current tax law, their gain is taxable at 26% (combined state and federal tax) payable when they sell the property: their tax bill will be $228,500.

“I knew getting the whole million was too good to be true,” Stan tells Sally. Before they sink into despair, the accountant explains, “there is a highly attractive route around the problem, one you need to know about. You can place the property in your own tax-exempt charitable trust, control the proceeds from the sale of the property and receive the income from the whole $1,000,000 for the rest of your lives. Do this and you will still leave your family more money than the alternative of selling the property, living off of the income from the after-tax proceeds and then give your family the principal after the last one of you dies. Let me explain how…”

|

Income for Life, AND leave more to your Heirs!

|

|

|

Tax-Exempt Trusts

The Advantage of Using A Trust Rather Than Selling Outright

The accountant suggests that the Hills forget about selling the property outright. He advises them to transfer it into a tax-exempt charitable remainder trust (CRT) with themselves as the trustees, and income beneficiaries. This enables them to sell the property without paying any taxes on the sale. The proceeds from the sale can then be invested through the Trust. He lists many of the advantages the Hills will realize:

• Avoidance of capital gains tax on the sale as already noted. They will have the full selling price of $1,000,000 to invest and from which to earn income rather than the $772,500 they would have if they sold the property outright. They will also avoid the Alternative Minimum Tax for even greater savings.

• Income for the rest of their lives (after the death of the first spouse, the survivor will continue to receive the income). They can set the payout rate, but it must be a minimum of 5%. In this case they will receive 8% from the trust income, spend the same amount of money as if they had sold the property without the trust, and invest the after-tax difference of $15,562. The Hills will continue, as trustees, to control the assets and in consultation with their financial advisor will allocate the assets into investments with which they feel comfortable.

• An immediate charitable deduction for that portion of the trust assets that will eventually pass to the charity (IRS mortality tables and discount rates are used to make this calculation). For the Hills, assuming an 8% payout rate, the charitable deduction will amount to $152,420 or an actual cash tax savings of $42,678. This amount will also be reinvested to leave to their family.

• Avoidance or reduction of estate tax, because the property placed in the trust will be wholly or partly removed from the Hill estate. Moreover, the assets will avoid probate proceedings.

• Relief from paying expenses associated with owning property (tax and insurance), and relief from management responsibilities.

• Satisfaction of knowing they will be making a substantial gift to a charity of their choosing, to be used in accordance with their wishes.

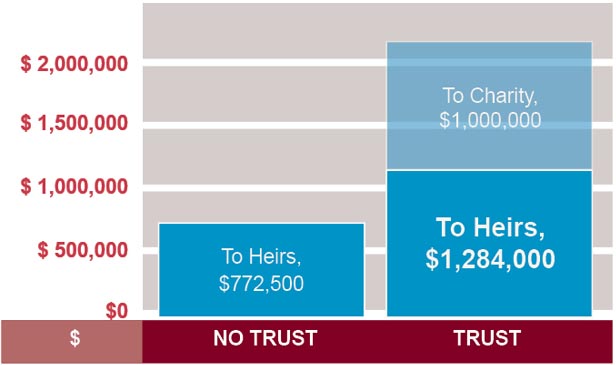

The accountant points out that establishing the trust need not reduce the size of the Hill children’s inheritance. Their children can be provided for in various ways, including the use of asset replacement insurance. Premiums for the insurance can be funded in most cases with the charitable deduction savings, plus the increased cash flow they will get as a result of avoiding capital gains tax. Their children will receive as much or more than they would have if the trust had not been used. In the above illustration instead of only leaving $772,500 to their children they will have over $1,284,000 to leave their children.

For the Hills and for countless others in similar situations the advantages are clear: Transfer property that has grown in value into a tax-exempt trust before its sold. (Refer to accompanying table for a line-by-line comparison).

|

| | | | | | |

|

|